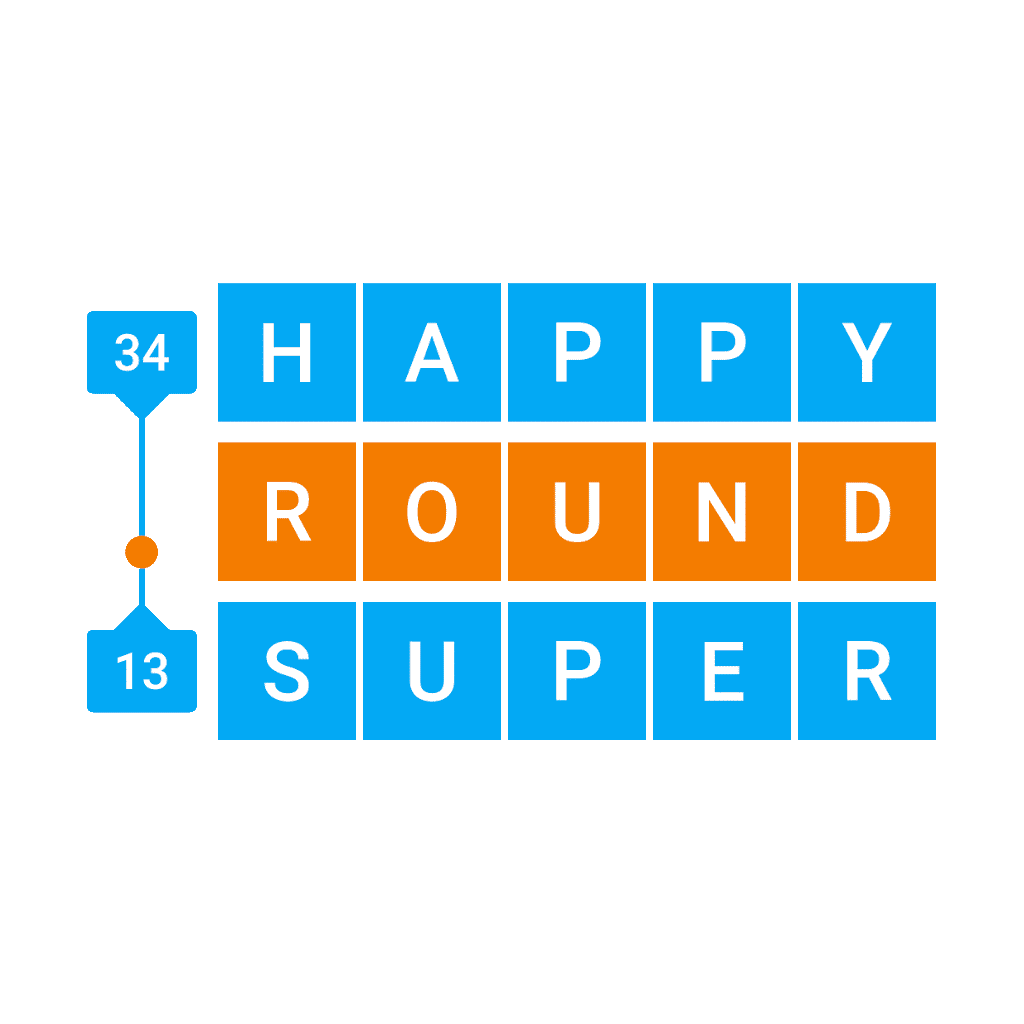

Recently, a social media buzz, about users spending more time on The New York Times' (NYT) games app than on its news app caught my attention. This info, coming from ValueAct Capital based on data from Yipit, appeared in a recent SEC report. I became curious about the broader impact, beyond app usage and how different games within NYT Games were shaping this transformation. So, I researched further and eventually turned on to Google Trends to uncover deeper insights into the evolving landscape of NYT Games and the factors driving this shift. Google Trends is a resource that helps users understand the popularity of search topics on Google, offering insights into trends and relative interest over time, ideal for those seeking to gauge public curiosity.

Key Findings:

- The NYT Games expansion was initially propelled by the success of Spelling Bee after 2017. Wordle was a pivotal moment in 2022. The addition of Connections in 2023, accelerated the growth and challenged the supremacy of NYT's news.

- The synergy among different games within NYT Games has been instrumental in their collective growth. Wordle and Connections, in particular, have attracted diverse audiences, including Gen Z, and influenced the content of traditional games to cater to these new demographics.

- Beyond engaging players, NYT Games has contributed to the overall business by capturing younger audiences and expanding its presence on emerging social media platforms like TikTok, enhancing brand visibility and relevance in contemporary digital spaces.

The New York Times Gaming Landscape

AHA Moment: Users now devote more time to The New York Times' (NYT) games app than its renowned news platform. 🎮

Image credit: ValueAct Capital

Inside the New York Times' Big Bet on Games is the most in-depth exploration of The NYT's ambitious foray into gaming I found so far. I deeply recommend reading it. It offers a meticulous and comprehensive analysis, covering pivotal moments for the games, team, and business, explaining also the strategic integration of games within the NYT ecosystem.

Evolution of NYT Games: A Crisp Timeline

The timeline below, Inspired by insights from Vanity Fair's article, traces the evolution of NYT's gaming division from its humble beginnings with the crossword puzzle to the driver part of the NYT ecosystem it became.

- 1942: NYT introduces the crossword puzzle in its paper, providing relief from wartime news.

- 1993: Will Shortz becomes editor, working on transforming the puzzle and including modern terms. The 2006 "Wordplay" documentary boosted Crossword's mainstream appeal.

- 2014: Launch of the Crossword app and daily puzzle, The Mini, leading to increased popularity of the puzzles.

- 2016: Games team begins to expand to include various roles like engineering, product management, marketing, design, and new editors.

- 2020: Games subscriptions surge to over 850,000, prompting rebranding to Times Games.

- 2021: Games subscriptions reach 1 million, Spelling Bee integrated into the Crossword app.

- 2022: NYT quickly acquired Wordle in January 2022 due to its rising popularity fueled by SNL mentions, celebrity endorsements (Anderson Cooper, Monica Lewinsky, Vice President Kamala Harris, Camilla), and TikTok influencers.

- 2023: Following the success of Wordle, NYT looked for its next hit game and found Connections, a word-association game pitched during Game Jam in 2021.

5-Year Trends of NYT's Crossword, Mini Crossword, and Spelling Bee

This Google Trends chart provides a detailed view of the five-year evolution of the original NYT Games - Crossword, The Mini Crossword, and Spelling Bee. These games exhibited a gradual growth trend until the latter part of 2021 and early 2022, followed by a steep surge in popularity during the second half of 2022 and throughout 2023. Noteworthy is the pivotal moment in January 2021 when NYT acquired Wordle, although this game is not reflected in the chart due to its overwhelming dominance compared to these older puzzles. Despite the current dominance of Wordle and Connections, they have also had a butterfly effect on the older games, contributing to significant growth in 2023. The NYT Mini saw a threefold increase, NYT Crossword doubled, and Spelling Bee's popularity increased by 1.5 times, indicating a broader trend of higher engagement with NYT's gaming offerings. However, it's important to note that limited free access or paid subscriptions for classic games like the Crossword or Spelling Bee may have constrained even greater growth during this period.

Wordle & Connections vs. Classic NYT Games

The chart above clearly illustrates the disparity between Wordle (green) and Connections (purple), and the classic NYT games—Crossword, The Mini Crossword, and Spelling Bee. The overwhelming popularity of Wordle and Connections is evident, overshadowing the growth trends of the traditional NYT puzzles during this period. Additionally, it's noteworthy that Wordle and Connections are widely accessible for free, contributing to their unmatched popularity and impact, extending beyond the NYT gaming sphere to become two of the most searched terms on the internet.

Classic Game Trends: Last 12 Months Analysis

Taking a closer look at the past 12 months, the trends for the classic NYT games—Crossword, The Mini Crossword, and Spelling Bee—reveal compelling insights. While these games are not the dominant players in the current NYT gaming landscape, supported by newer hits, they have experienced notable growth in the last months of last year with the shift becoming even more pronounced in 2024.

Beyond Expectations: All Games in the Last 12 Months

In the dynamic landscape of NYT Games over the past 12 months, a compelling narrative unfolds. The introduction of a new hit game, Strands (green line), in March 2024—still in Beta but already surpassing the classic offerings—signals a trend towards Wordle and Connections. Despite the notable discrepancy in growth rates between new and old games, the overall trajectory is one of continuous upward momentum. Gaming has definitely emerged as a prominent and sustainable facet, successfully challenging the supremacy of traditional news content.

The Power of Play: NYT's Winning Strategy

As we reflect on the exciting journey of NYT Games and its evolving landscape, the future appears bright and promising. Here's why NYT's gaming journey is not just a game—it's a winning strategy:

- Global Gaming Trends: With over 3.32 billion gamers worldwide in 2024, gaming is more than just a hobby—it's a global phenomenon. NYT Games taps into this massive audience with accessible and engaging experiences, catering to the dominant casual gaming market.

- Innovation in Action: NYT's commitment to innovation is evident through annual hackathons and the launch of multiple hit games each year. This creative spirit drives the development of unique and compelling gaming experiences that captivate players.

- Unique Connection with Players: Unlike mass-market games, NYT Games fosters a special bond with players through human-driven design. Players engage passionately, much like sports fans discussing their favorite teams and players.

- Driving NYT's Business Forward: Gaming isn't just fun—it's a driving force behind NYT's expansion into new territories and younger demographics. From TikTok to innovative digital channels, NYT Games is propelling the brand into the future.

Get ready to press start on NYT's gaming revolution—it's not just about playing games, but shaping the future of media and entertainment!

NY Times Mini

NY Times Mini NY Times Crossword

NY Times Crossword NY Times Wordle

NY Times Wordle NY Times Connections

NY Times Connections NY Times Connections Sports Edition

NY Times Connections Sports Edition NY Times Strands

NY Times Strands NY Times Spelling Bee

NY Times Spelling Bee NY Times Pips

NY Times Pips Word Salad

Word Salad Contexto

Contexto Blossom

Blossom Betweenle

Betweenle Conexo

Conexo Bracket City

Bracket City Fluxis

Fluxis Stacks

Stacks Atlantic Crossword

Atlantic Crossword LA Times Mini

LA Times Mini LA Times Crossword

LA Times Crossword Word Hurdle

Word Hurdle Anagram Solver

Anagram Solver Scrabble Word Finder

Scrabble Word Finder Words With Friends Word Finder

Words With Friends Word Finder Atlantic Games

Atlantic Games LA Times

LA Times Zorzzle

Zorzzle Word of Fortune

Word of Fortune